Give to St. Katharine of Siena School

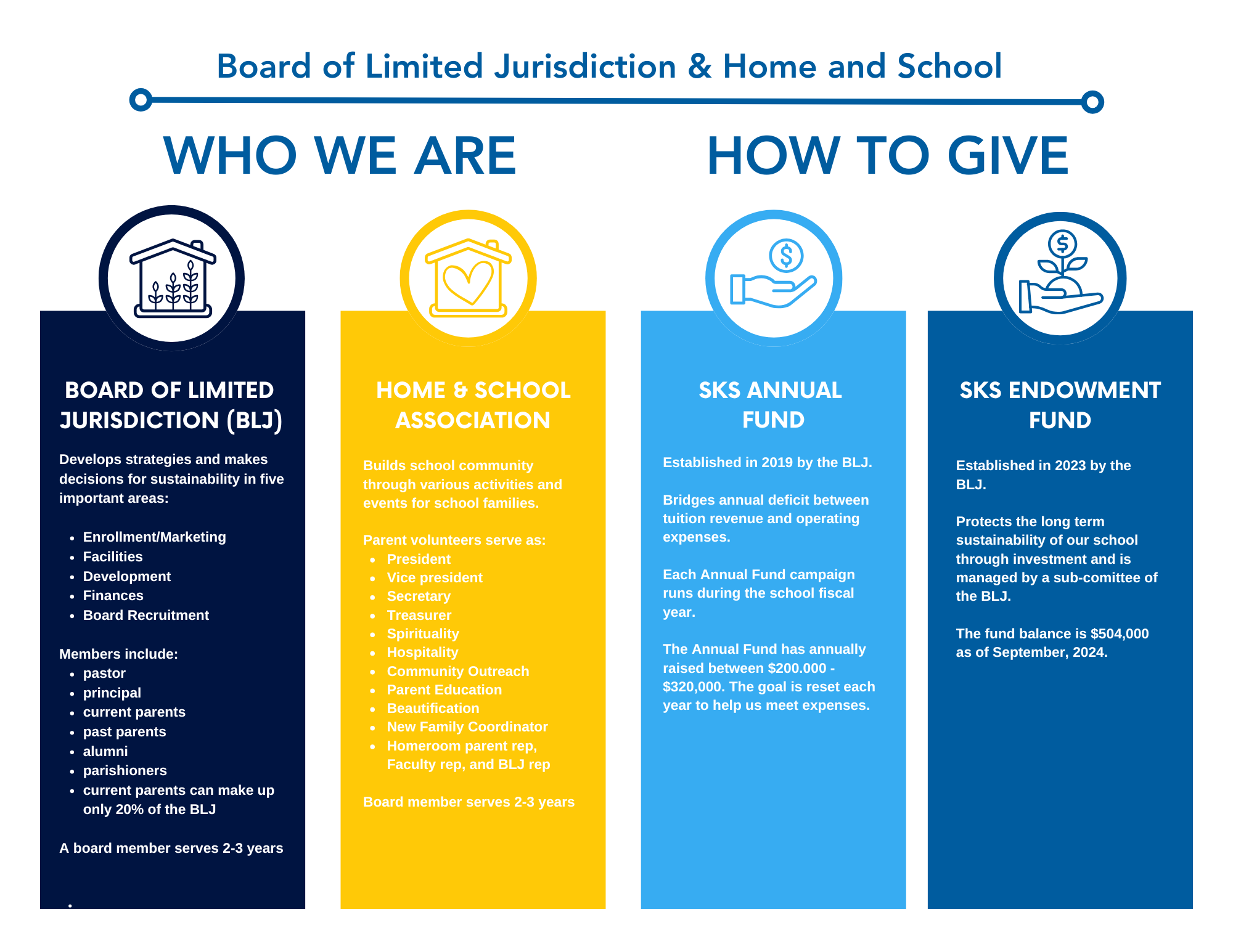

St. Katharine of Siena School relies on the generosity of the entire school community to help balance the school budget. As with many schools, our expenses often exceed our tuition income. We have been fortunate that current and past parents, alumni, grandparents, parishioners, businesses, corporate matching gift programs and foundations have supported us in both our Annual Fund and our Endowment Fund. Our short term needs are met with the Annual Fund, and our Endowment Fund is our long term investment for future sustainability. We are grateful for all donations at any level. Please know that every dollar raised will go directly to St. Katharine of Siena School and make an impact on the lives of our students, teachers, and families.

If you have any questions or need further information on how to donate, please contact Bud Tosti, Coordinator of Development and Alumni Relations, at btosti@sksschool.org or 610-745-0697.

Give to the Endowment Fund

SKS Endowment Fund

St. Katharine of Siena School | 116 S. Aberdeen Avenue | Wayne, PA 19087

Matching Gifts

EITC Tax Credits

Tuition Care Program

Give through your Required Minimum Distribution

Give a Specific Restricted Gift

Estate Planning

Gift of Securities/Appreciated Stock

Consider a donation of securities and appreciated stock which is processed through our financial advisor, Sims Financial Services at 610-688-5070. They will be able to guide you through the transaction process.